“We’re being asked to prove ROI on every MarTech tool. It’s brutal.” Enterprise CMO convo last week.

This conversation is happening everywhere and not just my calls.

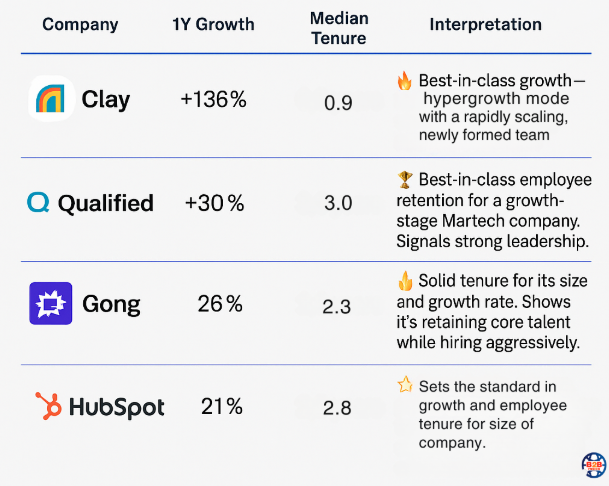

So we analyzed the LinkedIn data of 20 public and private MarTech SaaS companies.

What was measured? Employee growth + employee tenure metrics via LinkedIn across multiple timeframes – mainly because while it’s not an absolute

Assumption: employee hiring can be a key indicator of revenue growth in this harsh environment.

Here were the top 20% of companies that hired the last 12 months:

🎯 Clay – Hiring the fastest of any of the 20 companies

🎯 HubSpot – Steady expansion + empl retention despite size. Incredible unicorn right now.

🎯 Gong – Defying industry headwinds

🎯 Qualified – Great growth AND great tenure – culture indicator.

If you are bringing one of these 4 tools to your CFO, you are not alone.

The harsh reality for the other 16 we analyzed…

Most are barely hitting ~10% annual headcount growth if at all.

It’s why you are hearing about CAC and efficiency right now – the other 80% are maniacally focused on retention and upsell because revenue growth has likely stalled if hiring has retracted.

Size matters in this downturn:

🔴 Sub-300 employees = extreme volatility in empl growth (or contraction)

🔴 1000+ employees = stagnation mode in hiring percentages (except Gong/HubSpot)

🟢 Those mid-market companies with capital = acquisition hunters

Bottom line – world according to Jon: We’re about to see some serious MarTech consolidation. Companies will grow inorganically. Or stating the obvious – AI will soon displace those that struggle or are too expensive.

Are you seeing this ROI scrutiny impact your MarTech decisions?

___________

Companies analyzed using LinkedIn available data:

Clay (see our Blog for more info on Clay)

Qualified

HubSpot

Gong

6sense

ZoomInfo

Demandbase

Salesloft

Outreach

Sendoso

Chili Piper

Mutiny

LeanData

Bombora

Validity Inc.

Influ2

Intentsify

PathFactory

ChurnZero

Gainsight

UserGems