B2B FUSION

We SIMPLIFY your sales and marketing operations so you can focus on GROWTH.

Free Consultation

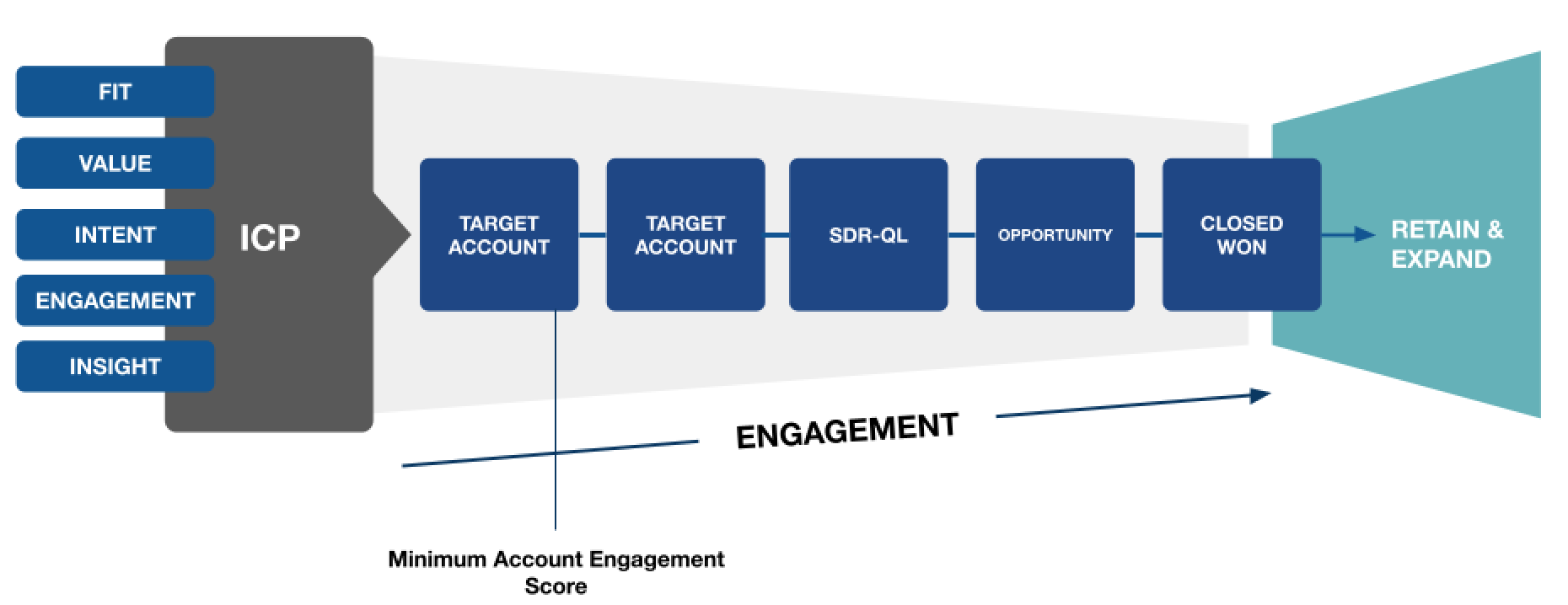

The Unified Funnel is key to

your company’s growth

Recent B2B Fusion Engagement Results:

- Sales is more productive working only qualified accounts

- Sales saves time with fewer SFDC motions, with more account insights

- Marketing has credible board level reporting sourcing 44% of revenue

- Marketing confidently can forecast their 2021 top line growth

- Marketing saves money and time by using existing MarTech vs. ‘burning down’ and starting over

Gartner TOPO Funnel 2021

What our clients say about us…

Resources

Read and listen to how we think of our Account Based and Revenue Acquisition Strategies.

How To Find Us

Drop us a note and share your challenges.

New York City | New Jersey

+1 833-REV-MKTG (738-6584)

hello@b2bfusiongroup.com