OUR POINTS OF VIEW ON SALES & MARKETING REVENUE STRATEGY

Resources for youResources

The Jolt Effect

In the high-stakes world of sales, it's essential to pinpoint the real roadblock to closing deals. It turns out, the culprit is often not a customer's comfort with the status quo but their sheer indecision. "The Jolt Effect" sheds light on this, revealing through...

6sense ABX Roadmap – our hot take

TLDR; World according to Jon's interpretation of the roadmap session and based on our depth of ABX experiences across 6sense platform and others - with its breadth of new capabilities, 6sense appears to be wanting to compete more with ZoomInfo (as a more sophisticated...

Rattlesnakes & Status Quo

60 percent of deals in the pipeline are lost to 'no decision' rather than to competitors. One positive aspect of this pandemic has been my journey of reconnecting with nature. Biking, hiking, walking - I haven't been outdoors this frequently in quite some time. It has...

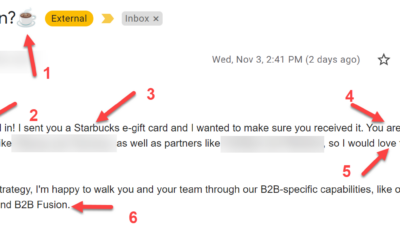

Email effectiveness

Email effectiveness during global pandemic. This is the most effective cold email I've received in 2021. This template could be reused at scale. First, she reached and prospected via email, not LinkedIn. 1. Subject line icon; studies consistently show higher...

We’re hiring!

Tired of working in the same system and seeing the same strategy over and over again, stagnating your career growth? Are you seeking a variety of customer challenges to mentally challenge your system, scaling and strategic mindset? Want to be on the cutting edge of...

How to Sell Your CFO on an Account Based Strategy Investment

(as published on CMS Newswire). It’s a complex time to be in business. Marketing has been elevated within the C-Suite as the driver of digital transformation and a key leader in the customer journey. At the same time it is facing renewed pressure to generate top line...

Videos

Featured Videos

B2B FUSION GROUP

Learn more about best practices by reading B2B Fusion in the News

Past Press

OPTIMIZE YOUR BUSINESS TODAY!

GET A FREE CONSULTATION

How To Find Us

Drop us a note and share your challenges.

New York City | New Jersey

hello@b2bfusiongroup.com